WikiFX Broker Assessment Series | Is Ivision Market Okay to Invest in?

Abstract:This article is about a broker called Ivision Market. Is this platform trustworthy? WikiFX made a comprehensive review of this broker, hoping you have a clue to make a wise decision.

About Ivision Market

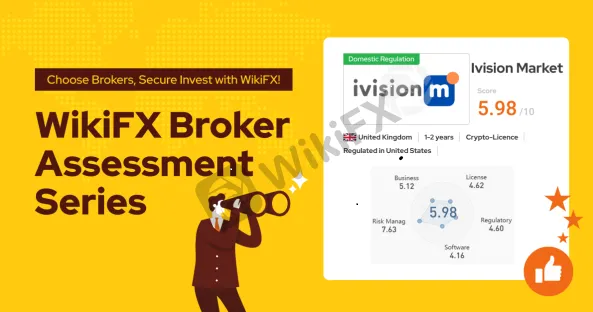

Ivision Market is an online forex trading platform that promises true ECN connectivity for clients using cutting-edge technologies and advanced trading platforms. Ivision Market emphasizes the fastest order execution, deep liquidity, and the tightest spreads. This broker claimed that when you choose to start trading with Ivisionmarket, you get unparalleled advantages and institutional-grade liquidity, along with a host of other benefits. Besides, Ivision Market offers a wide range of financial instruments, including Crypto-Currency, Precious Metals, Energies, Shares, and Indices. According to what we mentioned above, WikiFX has given this broker a decent score of 5.98/10.

Is It Legit?

Yes, Ivision Market is a regulated broker. This broker has been regulated by the Financial Crimes Enforcement Network with license number 31000238442500.

Account Types & Minimum Deposit

This broker offers traders three different types of accounts. They are Micro account, Standard account, and Spread Account.

Trading Platform

The MT4 is currently the most popular forex trading platform along with the MT5 on the market. With a user-friendly interface, powerful charting tools, and a large number of custom indicators, Ivision Market uses MT5 as its main trading platform.

Commission&Spreads

The Ivision Market offers tight floating spreads across its different account types, ensuring that traders can enter and exit positions at competitive prices. The spreads vary depending on the account type and the financial instrument being traded. The Micro Account provides spreads starting from 1.9 pips, while the Standard Account offers spreads starting from 1.4 pips. The Spread Account is designed for traders who want to trade with zero spreads or very low spreads, and as such, it provides spreads starting from 0 pips.

It’s important to note that trading conditions are subject to change and may vary depending on market volatility and liquidity. Traders should stay up-to-date with the latest market news and announcements to make informed trading decisions.

Fees & Commissions

IVISION MARKET has a policy of NO commissions on trading and only charges spread on trades. Spreads are the difference between the bid and ask price, and the amount of spread depends on the trading account type and market conditions.

The deposit and withdrawal fees vary depending on the payment method and currency used. Bank wire transfers are free for both deposit and withdrawal, but they may take 1-5 business days to process. Credit/debit cards and digital payment methods have NO deposit fees and are instant, but some withdrawal methods may have fees, and the processing time may vary.

IVISION MARKET offers a range of local payment methods that have no deposit fees and fast processing times. The withdrawal fees for local payment methods are also free, and the processing time is usually within an hour.

Conclusion

WikiFX Rating System is updated in real-time, ensuring investors have access to the latest, most accurate, and comprehensive broker information. The WikiFX score of a broker can be increased or decreased if the broker is constantly running the business in a good or bad direction.

Ivision Market is a decent broker that may suit your needs, although there are a lot of excellent alternatives you may consider.

If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.

Disclaimer:

The material provided through message/email should not be regarded as a solicitation/recommendation to deal (Buy/Sell) in any investment product. Trading in financial markets risks substantial losses and is unsuitable for all investors. Ivision Market does not warrant the information’s accuracy, suitability, or reliability and accepts no liability for damages from the information contained herein.

Risk Warning:

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. It would be best to consider whether you understand how CFDs work and can afford to risk losing money. Past performance is not an indication of future performance. The Client is responsible for ascertaining whether they are permitted to use the services of the ivision market brand based on the legal requirements in their country of residence.

If you have any more questions, please feel free to contact us.

Contact Us: +971 503571984

If you have any more questions, please feel free to contact us.

You are receiving this email because you have transacted with the ivision market or

We are registered on our website.

© 2021-2023 Ivision Market Limited. All rights reserved.

Ivision Market Limited (from now on referred to as the ‘’Company’’) is registered by the Registrar of Companies for England and Wales, with registration number 13573035.

iVision Market Limited is regulated by the National Futures Association (NFA) United States license ID: 0553552. The Company is compliant with Commodity Trading Advisor Exemptions from CTA registration Exemption Type: 4.14 (1)(8) Exemption is processed through NFA’s Exemption System Commodity Pool Operator According to NFA records, this firm operates pools listed below. The Commodity Exchange Act (CEA) regulates commodity futures trading in the United States. It was passed in 1936.

FinCEN exercises regulatory functions primarily under the Currency and Financial Transactions Reporting Act of 1970, as amended by Title III of the USA PATRIOT Act of 2001 and other legislation, which legislative framework is commonly referred to as the “Bank Secrecy Act” (BSA). The BSA is the nation’s first and most comprehensive Federal anti-money laundering and counter-terrorism financing (AML/CFT) statute. In brief, the BSA authorizes the Secretary of the Treasury to issue regulations requiring banks and other financial institutions to take several precautions against financial crime, including the establishment of AML programs and the filing of reports that have been determined to have a high degree of usefulness in criminal, tax, and regulatory investigations and proceedings, and specific intelligence and counter-terrorism matters. The Secretary of the Treasury has delegated the Director of FinCEN the authority to implement, administer, and enforce compliance with the BSA and associated regulations.